One sentence summary

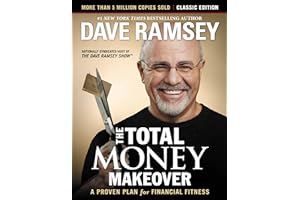

The Total Money Makeover: Classic Edition by Dave Ramsey is a personal finance book that outlines a 7-step plan to help you get out of debt and achieve financial fitness.

Book genre

Self-help, Non-fiction.

Main topic of the book

The book details a 7-step plan for financial fitness that was designed and perfected by the author during his years of helping individuals and families get out of debt and gain control of their finances.

Key Ideas

- Change Mindset: The book encourages readers to change their mindset and be willing to challenge their perception of money.

- Be a Proactive Investor: It emphasizes the importance of being proactive when it comes to investing and managing your money.

- Focus on Debt-Free Living: The book also advocates for debt-free living, where you become debt-free and stay debt-free.

- Commit to Financial Fitness: Finally, the book emphasizes the importance of committing to financial fitness and developing sound money management habits.

Main Parts of the Book and Short Summary

- Part 1: Laying the Groundwork – This section focuses on defining a budget, attaining financial peace of mind, and understanding the psychological impacts of money.

- Part 2: The Seven Baby Steps – This section lists the 7 steps that are necessary to get out of debt and achieve financial success. These steps include saving $1,000, paying off debt from the lowest balance to the highest, building an emergency fund, investing, college planning, buying a home, and saving for retirement.

- Part 3: Dumping Debt – This section covers the different methods of dumping debt. It discusses understanding credit, debt consolidation, bankruptcy, and how to handle creditors and debt collectors.

- Part 4: Saving and Investing – This section discusses the importance of intelligent investing along with outlining the different options available such as stocks, mutual funds, bonds, etc.

- Part 5: Financial Musts – This section covers the must-do of personal finance outside of tackling debt. It covers understanding insurance, estate planning, college planning, and asset protection.

Key Takeaways

- Budgeting and tracking expenses are key to managing and creating wealth.

- It is essential to prioritize paying off your debts from smallest to largest.

- The earlier an individual starts planning for retirement, the better.

- Investing should be done with an understanding of the risks involved.

- Choosing the right insurance policies for your needs is equally as important.

Author’s background and qualifications

Dave Ramsey is an American financial author, speaker, radio host, and television personality. He wrote his first book “Financial Peace” in 1993 and has written several other books on the topics of personal finance, self-improvement, and entrepreneurship. He has been named the #1 Brand for Financial Coaches and has helped millions of people become debt-free and financially independent.

Target Audience

The book targets individuals of all ages and backgrounds who are seeking to achieve financial fitness and become debt-free.

Publisher and First Publication Date

The Total Money Makeover: Classic Edition was first published by Ramsey Press in 2003.